Picture supply: Getty Photographs

It’s unattainable to know which progress shares are going to massively outperform the UK market. That stated, there are some I definitely want I’d purchased for my Shares and Shares ISA three years in the past.

Listed below are two of them.

SpaceX-fuelled progress

Filtronic (LSE: FTC) has been on hearth in 2025 – it’s up 105%. Over three years, it’s rocketed by 1,367%!

Talking of rockets, Filtronic signed a strategic partnership with SpaceX in 2024 to provide radio-frequency modules for the US agency’s satellite tv for pc web constellation (Starlink).

This relationship has gone from power to power, and earlier this month Filtronic acquired a follow-on order from SpaceX value $32.5m (£24m). This was the biggest deal in worth thus far, and it’s anticipated to be fulfilled in FY26 (which has simply began).

Consequently, administration is assured it “will exceed present income expectations” for this fiscal 12 months. That earlier expectation was for roughly £52m, up from £16.3m in FY2023.

In the meantime, Filtronic says it’s persevering with to put money into its know-how roadmap to capitalise on “the sizeable market alternative”.

This chance does look massive. With SpaceX persevering with to deploy extra satellites, further floor infrastructure shall be wanted, thereby presumably driving additional demand for the Filtronic’s modules.

Moreover, there must be progress alternatives within the defence market, to which Filtronic provides elements for navy communication and radar methods. Prospects embrace BAE Methods.

What may go fallacious? Effectively, the significance of the SpaceX partnership can’t be overstated. It already made up the majority of the agency’s gross sales previous to this newest order. In different phrases, there’s now vital buyer focus threat.

The inventory additionally appears dear. In line with the most recent forecasts, the ahead price-to-earnings (P/E) ratio is almost 54. So buyers at the moment are having to cough as much as make investments on this SpaceX-related progress story.

Fintech disruptor

A second UK inventory I want I’d purchased earlier is Clever (LSE: WISE). It’s up 43% up to now 12 months and 173% over three years.

Clever is a worldwide fintech agency that specialises in low-cost worldwide cash transfers. Its charges are dramatically decrease than these of conventional banks and it continues to draw shoppers and enterprise.

For the 12 months ended 31 March, it moved £145.2bn throughout borders for 15.6m folks and companies, a 23% year-on-year improve. Roughly 65% of transactions had been accomplished in underneath 20 seconds!

Income jumped 15% to £1.2bn, whereas underlying pre-tax revenue climbed 17% to £282m. That was equal to an underlying pre-tax margin of 21%. Earnings per share rose 18% to 40.4p.

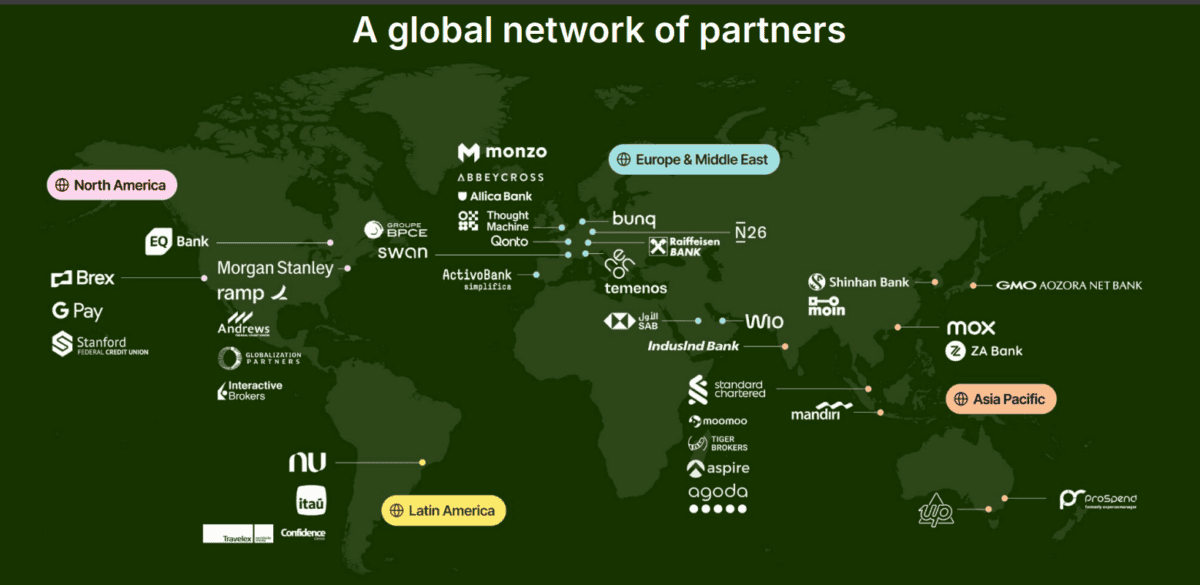

In the meantime, Clever expanded its world attain by connecting to new home cost methods within the Philippines, Japan, and Brazil. And it signed main new partnerships with Morgan Stanley, Commonplace Chartered, and Nubank.

I’d say the largest threat is the unsure financial backdrop. Have been a worldwide recession to happen, cross-border exercise may rapidly decelerate.

Apparently although, Clever is now the Eleventh-largest holding for FTSE 100 funding belief Scottish Mortgage. It says: “A number of progress avenues are open to Clever…these alternatives give Clever the flexibility to develop many occasions from its present base.”

Trying forward, the agency sees a $32trn marketplace for its infrastructure. So the long-term progress alternative stays very massive certainly.

Of the 2 shares right here, I choose Clever. It’s buying and selling at 28.3 occasions ahead earnings, and I believe it’s properly value contemplating.