Picture supply: Getty Photos

A lump sum of £15,000 may not appear life-changing. However with a sensible investing technique and sufficient time, it might type the muse of a sizeable passive earnings portfolio.

Traditionally, the inventory market has delivered common annual returns of round 8%–10%. At a ten% development fee, a £15,000 funding left untouched might compound into roughly £300,000 in 32 years. From there, a 5% yield might generate £15,000 in annual passive earnings — basically turning financial savings right into a wage.

That’s one option to do it. However there’s a option to get there sooner.

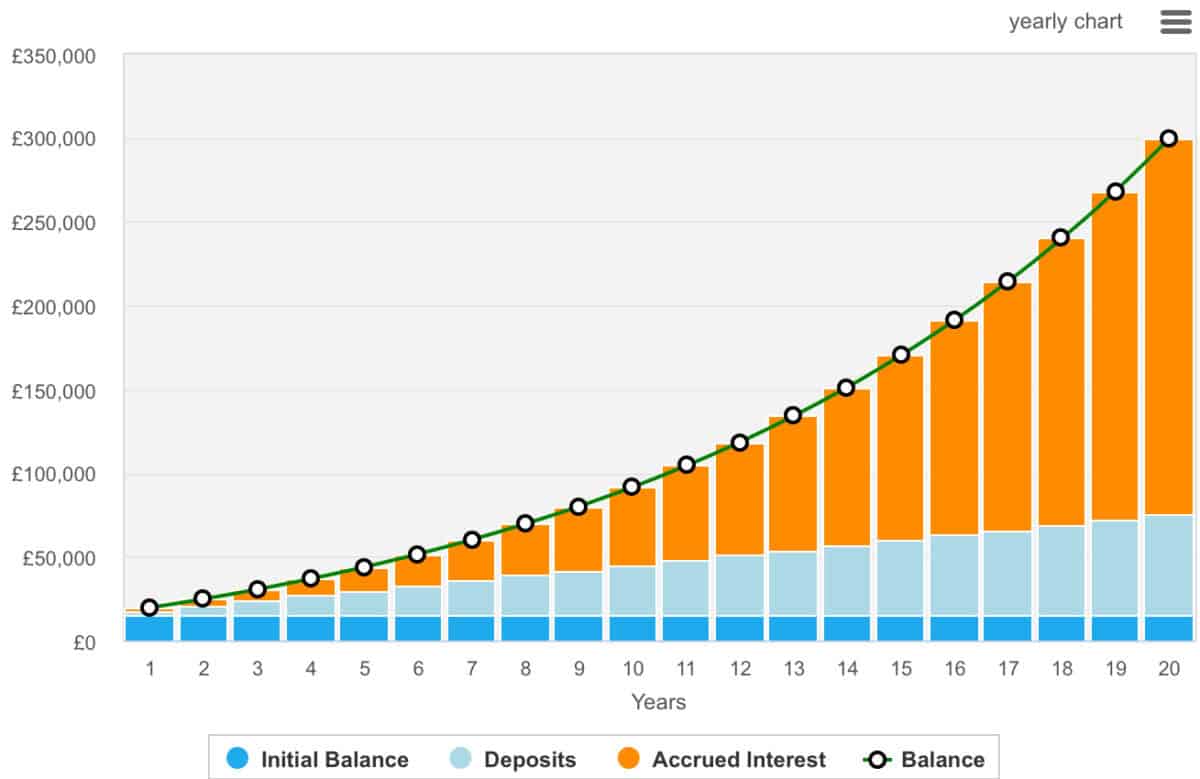

By including simply £250 monthly and reinvesting all returns, an investor might attain almost £300,000 in simply 20 years, assuming that very same 10% development. That’s lower than half the time in comparison with a lump sum alone.

Right here’s how the numbers stack up:

- After 10 years: roughly £91,800

- After 15 years: roughly £170,400

- After 20 years: roughly £299,800

Compounding is the key sauce

This spectacular finish outcome comes from combining common contributions with compounding returns. Every month-to-month deposit has the prospect to develop and multiply over time, accelerating wealth creation. Simply take a look at how the accrued curiosity grows over time.

To guard good points and earnings from tax, investments will be held inside a Shares and Shares ISA, the place each capital development and dividends are shielded from HMRC.

So, what’s key to success? Persistence, consistency, and a long-term mindset. Dividend-paying shares, low-cost index funds, and international fairness trusts can all play a task in constructing a resilient, income-generating portfolio.

It’s a easy thought — however one that would change the trajectory of a monetary future. Nevertheless, traders must be cautious that they will lose cash, particularly over the quick time period.

Please word that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Investing to beat the market

Novice traders might want to begin their investing journeys by shopping for index monitoring funds. This can be a tremendous diversified option to get going.

Nevertheless, extra bold traders might want to choose particular person shares. One inventory I like is Pinterest (NYSE:PINS). It seems attractively valued for a platform with robust earnings momentum and rising AI integration. The corporate sits on a internet money place of $2.5bn and trades at simply 19.9 instances forecasted earnings for 2025 — falling to 10.6 by 2028 based mostly on present consensus.

Analysts anticipate earnings development of almost 40% in 2025, pushed by improved advert monetisation, deeper engagement, and AI-powered content material curation. Pinterest’s skill to hyperlink visible discovery with procuring makes it uniquely positioned within the social commerce house, for my part.

Nevertheless, the important thing danger is aggressive strain. Bigger platforms like Meta and TikTok are additionally investing closely in AI and commerce, and Pinterest’s smaller scale might restrict its attain and pricing energy in digital advertisements.

That stated, with robust financials, constant person development, and an enhancing margin profile, I imagine the shares are price contemplating at present ranges.