Picture supply: Getty Pictures

I’m satisfied that purchasing UK shares is the easiest way to construct long-term wealth. I actually have opened a Shares and Shares ISA, an instrument that enables me to speculate as much as £20,000 in development and dividend shares with out having to pay tax.

Please notice that tax remedy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

Right here’s how — because of the miracle of compound curiosity — I’m hoping I might flip this right into a five-figure passive earnings as soon as I retire.

Investing within the FTSE 100

For many years, UK shares have been an effective way for common buyers to make money. The FTSE 100, as an illustration, has delivered a mean annual return of seven.48% because it got here into being 40 years in the past.

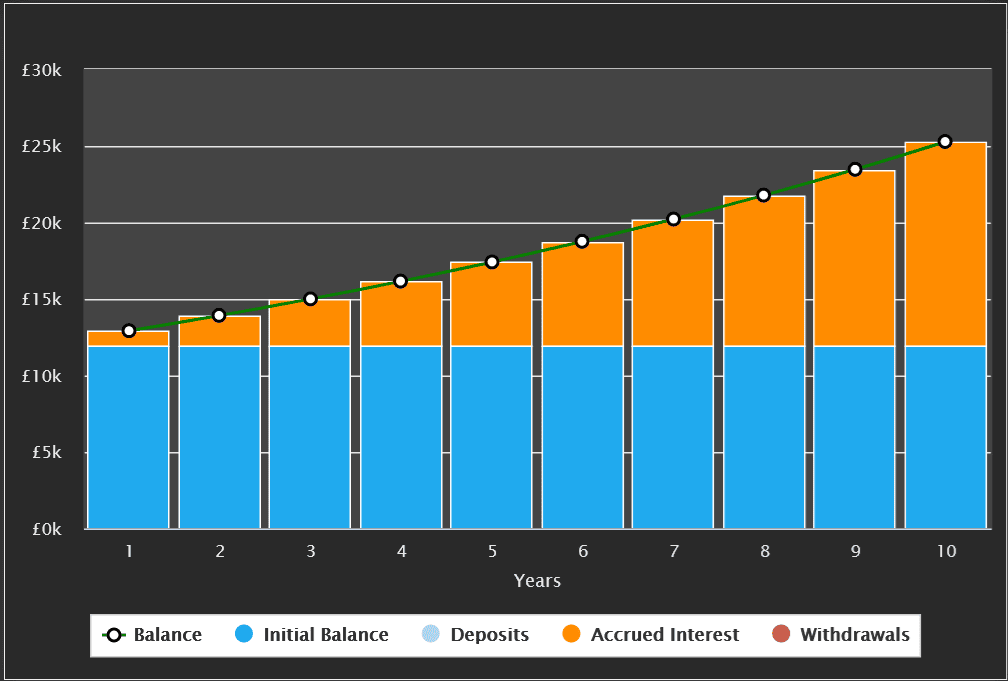

If that annual common have been to proceed, I might, with an funding of £12,000 in Footsie shares at this time, make a revenue (excluding charges) of £897.60.

Over a 10-year interval I might have made a formidable £8,976. This is much better than any financial savings account might have made me over that point.

However that is assuming that I withdrew my yearly positive factors as passive earnings to spend. With compounding, the place I plough again any dividends I obtain, I’ve a possibility to extend (and probably life-changing) returns.

With dividends reinvested, I might make an funding pot value a whopping £25,294.45, as proven beneath.

Compound positive factors

The fantastic thing about compound curiosity permits me to earn money on any dividends I reinvest in addition to on my preliminary funding. And if I can afford to speculate commonly after shopping for my first FTSE 100 shares, my eventual return might actually take off.

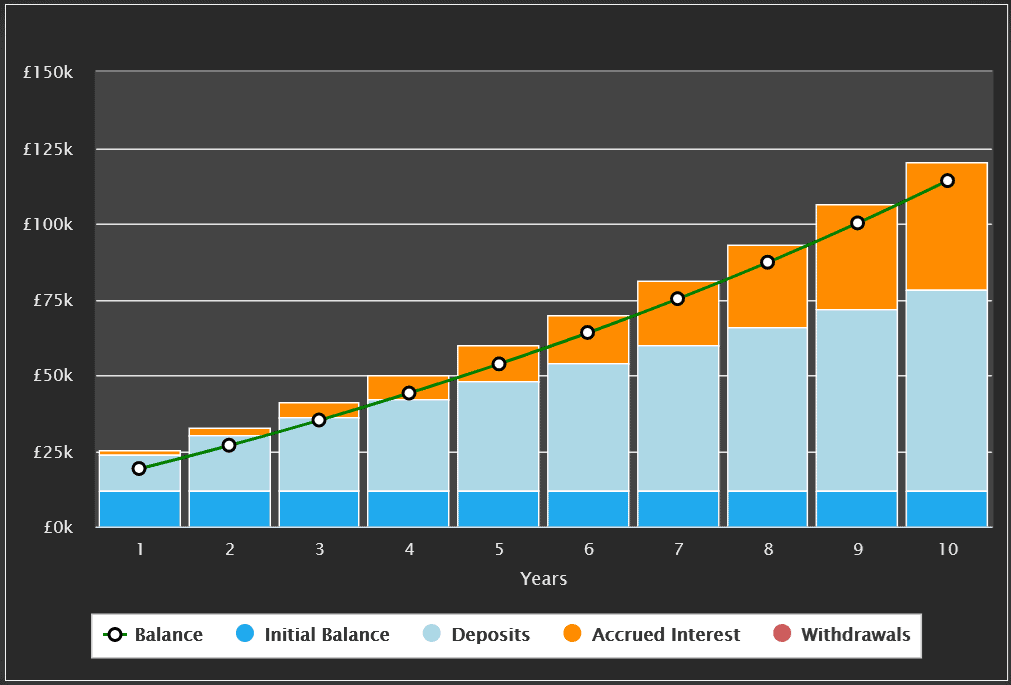

Let’s say that I should purchase one other £500 of Footsie shares every month. That’s on prime of the £12,000 I’ve already used to speculate. I might have an enormous £114,161.10 sitting in my account, as seen within the chart beneath.

£31k+ passive earnings!

As I discussed on the prime, I’m shopping for shares to assist me stay comfortably once I retire. So I plan to proceed investing in FTSE 100 shares up till that time.

That is the place issues actually get thrilling. The precept compounding implies that the longer I make investments for, the higher sum of cash I can anticipate as soon as I cease.

If I invested that £500 a month for 30 years, I might have constructed up a pot of £783,417.49, assuming that 7.48% annual common stays the identical.

Making use of the 4% retirement drawdown rule — which might give me cash for 3 a long time earlier than my investments run out — would supply me with a yearly passive earnings of £31,336.70.

A good way to speculate

In fact previous efficiency isn’t any assure of future success. That common price of return might effectively erode within the coming years because of firm, business, and macroeconomic components.

However these figures above present what might be achieved. The rising variety of Shares and Shares ISA millionaires additionally underline what might be achieved by drawing up and sticking to an funding plan.

And the possibilities of profitable investing at this time are improved because of the wealth of knowledge accessible from specialists like The Motley Idiot.