Key takeaways

- The One Huge Stunning Invoice Act has launched a variety of tax cuts and changes that small enterprise house owners ought to take note of and put together for.

- New deductions round pass-through revenue, tipped and time beyond regulation wage and bonus depreciation can permit small enterprise house owners and staff to decrease their tax burden.

- The repeal of the de minimis rule means small enterprise house owners can anticipate to pay extra on smaller imported shipments.

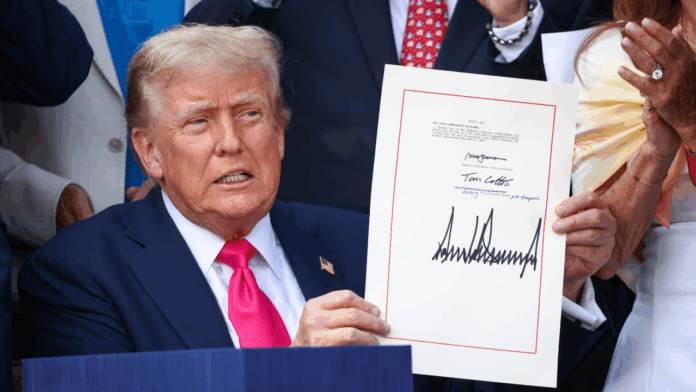

President Donald Trump’s megabill, the One Huge Stunning Invoice Act, launched a swath of tax cuts, deductions and changes for each shoppers and companies. Whereas proponents of the invoice have claimed the brand new deductions and extensions to the 2017 Jobs and Tax Cuts Act will assist small companies, it could show to be an economically blended bag in the long term. (Learn extra: Trump indicators megabill into legislation — right here’s what it means in your cash.)

“By heading off a tax enhance on the finish of this 12 months, a possible headwind has been eradicated. And this could present some added momentum to development and shopper spending,” says Mark Hamrick, senior financial analyst for Bankrate. “On the identical time, the impacts concerning the federal debt and deficits are additionally consequential, lending upward strain on rates of interest for the foreseeable future.”

With the brand new and prolonged deductions turning into efficient for the 2026 tax 12 months, small enterprise house owners ought to begin working with their tax preparer as a way to take benefit as quickly as attainable.

“Small enterprise house owners ought to seek the advice of with a tax skilled earlier than year-end to grasp how the brand new provisions within the invoice have an effect on them,” says Kem Washington, CPA and former income agent and prison investigator for the IRS. “They need to concentrate on key modifications that will affect each enterprise and private taxes.”

Right here’s what you want to find out about how the massice new legislation will affect your online business, and what you need to do to adapt.

Abstract of the Huge, Stunning Invoice’s enterprise affect

In a rush? Right here’s the Huge Stunning Invoice’s enterprise affect in a nutshell.

|

Invoice provision |

What it means |

What you need to do |

|

No tax on suggestions or time beyond regulation |

Staff rise up to a $25,000 deduction on tipped and as much as a $12,500 deduction on time beyond regulation wages |

|

|

Go-through deduction made everlasting |

Go-through enterprise house owners get a 20 p.c deduction on their certified revenue |

|

|

De minimis repealed |

Imports below $800 are actually topic to tariffs |

|

|

100% bonus depreciation |

Certified enterprise property bought or constructed after Jan 19, 2025 can have their depreciation deducted within the first 12 months |

|

| Extra versatile R&D writeoffs | Analysis and improvement bills between Jan 1, 2022 and Jan 1, 2025 might be deducted over one or two years. |

|

No tax on suggestions and time beyond regulation

The invoice introduces two huge tax breaks for staff: a $25,000 deduction on certified tip revenue, and a $12,500 deduction on time beyond regulation (or $25,000 if married submitting collectively), efficient 2025 by 2028.

Ideas are categorised as revenue obtained immediately from clients along with common revenue. Whereas suggestions might be earned by any employee, some staff work for tipped wages, with the expectation that almost all of their revenue will come from suggestions. The IRS says it should publish a listing of occupations that qualify for the brand new tax deduction by Oct. 2.

As for time beyond regulation, the Honest Labor Requirements Act of 1938 requires that hourly staff who’re in extra of 40 hours per week be paid time and a half per hour. Each time beyond regulation and suggestions are taxed as revenue and are required to be reported as revenue to the IRS, and are taxed as such.

Take into account that the worth of each of those tax deductions begins to section out for staff with modified adjusted gross revenue of $150,000 or extra ($300,000 or extra if married submitting collectively).

What it means for small enterprise

Tipped and time beyond regulation wage tax deductions might be seen as a win for staff with one of these revenue. For enterprise house owners, it could make recruiting tipped or time beyond regulation staff simpler, as you’ll be able to promote that they’ll be capable to take house extra pay.

Nevertheless, it does come as a blended bag. Sentiments about tipping have shifted into the destructive, with 41 p.c of People saying that companies ought to pay their workers higher as an alternative of counting on suggestions, based on Bankrate’s 2025 survey on tipping.

Furthermore, some labor advocates fear that companies will benefit from this rule to push staff to work for suggestions or time beyond regulation, as an alternative of providing a dwelling wage or conserving a balanced work schedule.

What you need to do now:

- Preserve monitoring tipped wages. Your workers would be the ones taking the deduction once they file, so be sure you be compliant with payroll tax and reporting legal guidelines.

- Don’t depend on deductions for a good wage. With altering sentiments round tipping, it is likely to be a greater concept to draw staff with a aggressive wage as an alternative of pushing for extra suggestions.

- Give attention to a wholesome working atmosphere. Guarantee that workers taking over extra time beyond regulation aren’t overextending themselves.

Go-through deduction prolonged

The pass-through deduction, or Sec. 199A, permits for enterprise house owners who immediately move by their enterprise income to their particular person revenue tax returns to deduct as much as 20 p.c of their certified enterprise revenue. This is applicable to LLCs, partnerships, S-corporations and sole proprietors who move by their revenue on this method.

Initially established in 2018, the deduction was set to run out this 12 months. Nevertheless, the “huge, lovely invoice” has now made it everlasting. It has additionally modified sure provisions across the deduction’s limitations, together with:

- An elevated deduction threshold from $50,000 to $75,000 for single filers, and from $100,000 to $150,000 for married {couples} submitting collectively.

- The minimal deduction quantity has been adjusted to $400 for at the least $1,000 in certified enterprise revenue, to be adjusted for inflation beginning in 2026.

These new guidelines will apply to tax seasons after Dec. 31, 2025.

What it means for small enterprise

With many small enterprise house owners receiving their revenue as pass-through, the now-permanent deduction implies that the decrease quantity of revenue taxes they’ve been paying since 2017 will proceed completely.

What you need to do now:

- Speak to your tax preparer. They may help you establish tips on how to declare the deduction and that you simply’re classifying your certified enterprise appropriately.

- Ensure you’re a pass-through enterprise. Solely sole proprietorships, partnerships, LLCs and S-corporations are eligible for pass-through revenue.

- Make sure that you’re deducting certified enterprise revenue. The IRS exempts sure forms of revenue, akin to wage revenue, and sure funding good points from being counted as certified enterprise revenue.

De minimis repealed

One tariff-related rule the brand new legislation has codified is eliminating the de minimis rule, which allowed imported packages below $800 to be exempted from U.S. tariffs. This new rule impacts drop-shipped objects particularly, as importers that ship packages on to the patron as an alternative of bulk-shipping now must pay a tariff.

What it means for small enterprise

When you depend on imports in your stock and supplies, you’ll seemingly begin paying extra for those who aren’t already. This may be significantly impactful on smaller customized orders from tariffed nations, as tariffs will apply to packages you could not have paid out earlier than alongside worth will increase from tariffs throughout the board.

What you need to do now:

- See the place your shipments are coming from. Figuring out your provide chain may help you make knowledgeable choices about the place tariffs are hitting you the toughest.

- Think about switching or dropping merchandise. Altering shipments to return from a lower-tariffed nation or a home provider may help hold prices low.

- See if you should buy in bulk. Bigger orders are sometimes cheaper per unit, offsetting the price of tariffs. Teaming up with different companies to separate cargo prices may also be useful.

100% bonus depreciation

The OBBB Act has prolonged bonus depreciation guidelines, which permit companies to deduct the complete quantity of an asset’s depreciation inside the first 12 months of buy, as an alternative of spreading it out over its depreciable life.

Asset depreciation — or how a lot the worth of an asset decreases over time — is a deductible expense for enterprise house owners. For instance, if a enterprise purchases a semi-truck for $200,000, and it depreciates by $5,000 every year, enterprise house owners can solely deduct $5,000 every tax 12 months of the truck’s helpful life — 5 years — as categorised by the IRS. This new rule applies to property positioned in service from Jan. 19, 2025 to Jan. 1, 2029.

Nevertheless, with the brand new bonus depreciation, enterprise house owners can now deduct the complete depreciation of the truck — $25,000 — up entrance within the 12 months of buy.

Producers and farmers also can now deduct the complete value of their manufacturing property within the 12 months it’s constructed. This will cowl the price of buy or the price of development (not together with the price of land). It applies to property that begins development between Jan 19, 2025 and Jan. 1, 2029, with the situation that the property should be put into manufacturing earlier than Jan. 1, 2031.

The manufacturing property deductions apply solely to certified manufacturing property, which is:

- Utilized by the taxpayer as an integral a part of a certified manufacturing exercise

- Positioned in service in america

- Unique use commences with the taxpayer (AKA, the individual taking the deduction must be the one utilizing the property for the primary time.

The manufacturing property deduction additionally solely applies to manufacturing, refining and manufacturing companies.

What it means for small enterprise

The depreciation bonus may help you offset property buy and development prices, as long as you file the deduction appropriately and perceive what counts as certified property. When you can select to deduct in the usual method — with smaller deductions taken out over the helpful lifetime of the property — it would make extra monetary sense to take out the one hundred pc deduction from the beginning, particularly for those who can put the cash again into the acquisition value.

What you need to do now:

- Speak to your tax preparer. They may help you make the fitting determination about which deduction to take, and the way a lot you’ll be able to deduct based mostly on the asset’s helpful life.

- Ensure that your property is certified. Manufacturing property has particular provisions for its deduction. That is outlined in additional element within the One Huge Stunning Invoice Act.

- Put your deducted money to good use. Apart from placing the cash again into your online business or property, it’s also possible to bulk up your money reserves.

Extra versatile analysis and improvement tax writeoffs

When you conduct analysis and improvement (R&D) for product creation, market testing, software program creation or in any other case, you could qualify for an R&D expenditure tax credit score.

Below the One Huge Stunning Invoice Act, small companies can retroactively expense and deduct home R&D prices going again to Jan. 1, 2022, and accomplish that over one or two years as an alternative of 15 years below earlier legislation.

This new provision solely applies to home R&D. Any international R&D must be amortized over 15 years as earlier than.

What it means for small companies

Even when your organization isn’t within the analysis business, it’s nonetheless attainable to benefit from the brand new rule. Analysis and improvement is outlined pretty broadly, and may embrace:

- Researching product feasibility

- Product improvement or enchancment

- Software program improvement, enchancment, and testing

- Product design and modeling

- Analysis documentation

- Creating product fashions or demos

- Analysis gear upkeep

- R&D conferences

When it comes to what might be bills, wages, provides, software program subscriptions and contract bills associated to any of the above actions are thought of expensable.

What you need to do now

- See what you’ll be able to depend as R&D. With the definition being fairly broad, you may qualify even whenever you suppose you don’t.

- Speak to a CPA or tax preparer. They may help you discover bills that you could

- See for those who qualify for the retroactive deduction. Any R&D bills incurred from Jan 1, 2022 onward can qualify.

The underside line

The One Huge Stunning Invoice Act launched a variety of tax cuts and changes that small enterprise house owners ought to concentrate on. New deductions can permit employers and workers to take house extra pay, whereas the repeal of the de minimis rule might imply you’ll pay extra in tariffs. Remember to analyze your funds and discuss to your tax preparer so your online business is in good condition to benefit from and alter to the modifications launched by the brand new megabill.

Why we ask for suggestions

Your suggestions helps us enhance our content material and companies. It takes lower than a minute to

full.

Your responses are nameless and can solely be used for bettering our web site.

Assist us enhance our content material