Snapchat has printed its newest efficiency report, which, within the topline outcomes at the very least, reveals regular will increase in customers and income, because it continues to refine its enterprise choices, and capitalize on its market alternatives.

Although development in key markets stays a problem, with Snap persevering with to lose customers within the North American market, its key income supply, whereas rising prices additionally proceed to weigh on its general outcomes.

And its income outcomes are additionally not nice.

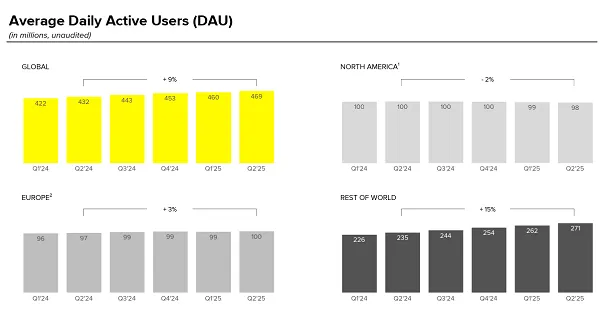

First off, on customers. Snapchat reached 469 million day by day energetic customers in Q2, a rise of 9 million on its Q1 numbers.

Once more, any development is a constructive, however the truth that Snap is shedding customers within the U.S. is a standout observe from this chart. Virtually all of Snap’s development continues to be coming from the “Remainder of World” class, with India specifically seeing extra take-up. However the U.S. and EU is the place Snap generates nearly all of its income, and as such, the stagnant outcomes listed below are probably problematic.

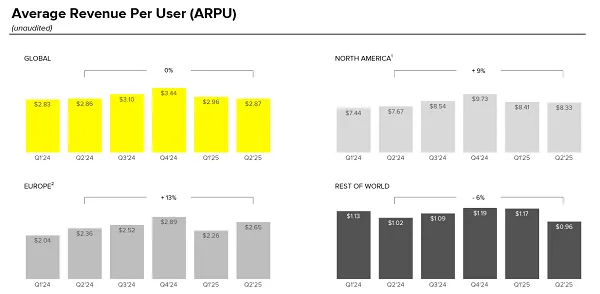

As you may see in these charts, Snap generates nearly 4x extra income per person from its North American viewers, and 800% greater than these within the “Remainder of World” section.

Constructing in additional markets clearly bodes effectively for future alternatives, as these areas proceed to develop their digital economies. However the regular decline of Snap utilization within the U.S. factors to a plateau, and a possible cap on Snap’s development.

However after all, Snap’s eager to concentrate on the positives, with the platform additionally inching nearer to a billion month-to-month actives, with 932 million month-to-month energetic customers (MAU), a rise of 32 million on Q1.

And general, the truth that Snap continues to be including tens of millions extra customers is an indicator of its enduring relevance and resonance, significantly amongst youthful customers.

We’ll see how the market responds to such.

On the income entrance, Snap introduced in $1.3 billion for the quarter, a rise of 9% year-over-year.

However once more, you may see the impression of its U.S. viewers decline right here, with its North American income down on Q1, whereas it’s additionally posted its lowest income end in 4 quarters.

And whereas Snap is targeted on its next-level bets, like AR glasses, it must hold producing income to maximise this component, and the chart tendencies right here don’t look nice.

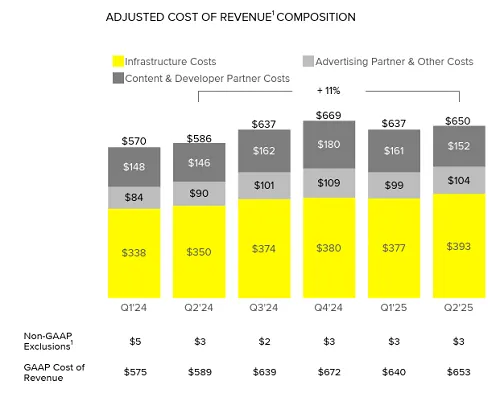

Together with this one:

By way of particular enterprise choices, Snap says that it’s seeing good outcomes with Sponsored Snaps, which at the moment are driving an 18% raise in distinctive conversions throughout app installs and app purchases.

Snap says that it’s additionally seeing extra engagement with its Highlight short-form video providing, with time spent within the Highlight feed rising 23% year-over-year, facilitating extra publicity choices. Certainly, Snap says that Highlight now contributes greater than 40% of complete content material time spent within the app, which may very well be price noting in your video advertisements.

Snap’s additionally been working to combine extra creator content material, through its Snap Stars program, with the variety of Highlight posts by Snap Stars rising greater than 145% year-over-year in North America in Q2.

So there are, at the very least in principle, alternatives there, and if Snap can facilitate extra model partnerships, resulting in creator monetization and elevated publicity potential for manufacturers, there’ll nonetheless be worth on this entrance, even when general utilization dips.

Snap additionally notes that use of its Snap Map has grown to greater than 400 million MAU, and with expanded promotional choices being built-in right here, that may very well be one other space of alternative.

However it’s Snapchat’s AR challenge, and the prices related to it, that stay a degree of competition.

Again in June, Snapchat introduced that it’ll launch its AR-enabled Spectacles subsequent yr, in an effort to beat Meta to market with a useful, trendy AR system.

Which is smart, as the symptoms are that Meta’s glasses shall be extra useful, trendy and cheaper, however the price of that challenge is probably going a major contributor to Snap’s growing infrastructure prices, together with its personal AI initiatives.

However Snap’s not constructing its personal AI instruments, it’s largely internet hosting AI experiences from OpenAI and Google, with the intention to energy issues like its “My AI” chatbot. As such, nearly all of its prices would probably be going in direction of this AR glasses push, which is smart within the broader scale of Snap’s long-term plan.

However in apply, it looks like this may very well be a catastrophe for the enterprise.

Certain, Snap customers are nonetheless considering AR, with Snap reporting that greater than 350 million Snapchatters now have interaction with its AR instruments daily, and Snap continues so as to add extra revolutionary AR makes use of, like its current integration with a TV present within the U.Okay.

However will additionally they purchase Snap’s AR glasses, and in the event that they do, will Snap be capable to preserve momentum for comparable to Meta continues to inch nearer to a launch of its AR system.

I don’t suppose that it is a race Snap can win, and Snap could be higher off growing AR experiences for different units, versus investing in its personal, which is wanting like a significant money drain, for what could be solely a short-term enhance in curiosity.

Snap’s internet loss for Q2 was $263 million, in comparison with $249 million within the prior yr. And because the prices proceed to rise, and person development stays a query, this looks like a giant level of concern for the app.