Snapchat has printed its newest efficiency replace, with the app, unsurprisingly, seeing a decline in day by day energetic customers, although it nonetheless posted a gradual rise in income for This autumn 2025.

And with Snap about to hit a important stretch for the way forward for the enterprise, with the launch of its AR Specs, the numbers listed here are vital for the corporate’s general basis transferring ahead.

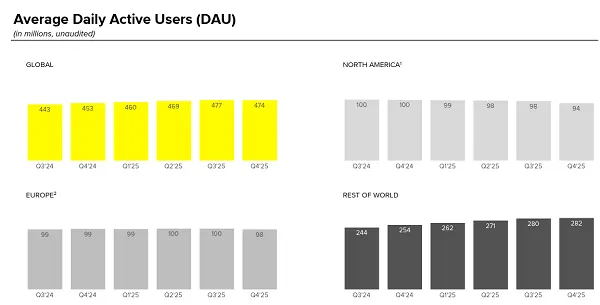

First off, on energetic customers. Snapchat misplaced 3 million day by day energetic customers versus Q3, and is now sitting at 474 million DAU.

Which, as famous, isn’t overly shocking, contemplating that Snapchat was banned in Russia in early December, as a part of the Russian authorities’s push to get extra individuals utilizing its personal social media app, whereas Snap additionally misplaced a heap extra customers in Australia only a few weeks after that, as a result of Australian authorities’s new beneath 16 social media restrictions.

These two actions would cumulatively have seen Snapchat lose an estimated 8.5 million customers in a matter of weeks, via no fault of its personal. With that in thoughts, the truth that Snapchat’s day by day utilization has solely declined by 3 million means that it’s truly completed fairly nicely to take care of engagement within the app.

Although as you possibly can see within the above charts, Snap can be shedding customers within the U.S., its key income market, and that doesn’t bode nicely for its future prospects.

Snapchat utilization has been steadily declining in each the U.S. and EU over time, which means that the app could have reached its saturation level, and that it’ll now need to depend on pumping in additional adverts to spice up its income consumption.

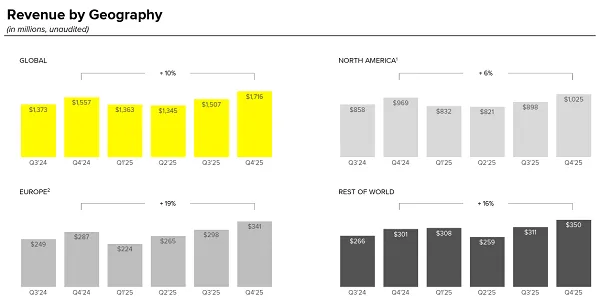

Although not less than at this stage, that’s working, with Snapchat bringing in $1.72 billion for the quarter, up 10% year-over-year.

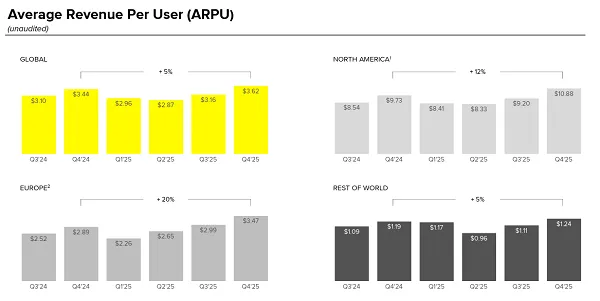

Although once more, Snap stays closely reliant on the U.S. marketplace for its income, with its common income per person not shifting sufficient within the “Remainder of World” class, year-over-year, to capitalize on its expanded alternatives.

Although Snap is engaged on this.

In its letter to shareholders, Snap says that it stays targeted on diversifying its income consumption, and driving the enterprise “towards extra worthwhile development.”

As per Snap:

“For the promoting enterprise, our focus will likely be on three core initiatives. The primary is fostering direct connections between Manufacturers and Snapchatters, by leveraging our core product capabilities throughout Snapchat. The second will likely be making it simpler and extra performant for advertisers to attach with Snapchatters by leveraging AI tooling and capabilities end-to-end via our advert platform, together with inventive improvement, marketing campaign setup, and efficiency optimization. Lastly, we plan to develop our advertiser base by scaling and optimizing our go-to-market operations that help the success of small and medium-sized companies (SMBs).”

SMBs have been an enormous focus, which has helped to drive the corporate’s income development, whereas Snap additionally notes that its non-advertising initiatives, together with Snapchat+ and extra Reminiscences storage, have helped to spice up consumption.

“Within the 12 months forward, we are going to deal with rising present subscription provides, whereas innovating to convey compelling new provides to our platform. This momentum is already materializing, with subscribers rising 71% year-over-year to succeed in 24 million in This autumn. Within the 12 months forward, development in subscribers will likely be a important enter metric to trace our progress, and we are going to finally grade our efficiency primarily based on development of the annualized run charge for Different Income.”

That’s an vital word, that Snap is now making an attempt to deal with maximizing the cash it may make from its present viewers, with a view to scale back the deal with development. That’s a riskier guess, as too many adverts will likely be intrusive, whereas subscription choices have by no means ended up being a significant income driver for any social media app, compared to advert spend.

However with development declining, Snap has little alternative however to make this the goal, within the hopes that buyers will not be delay by these person numbers.

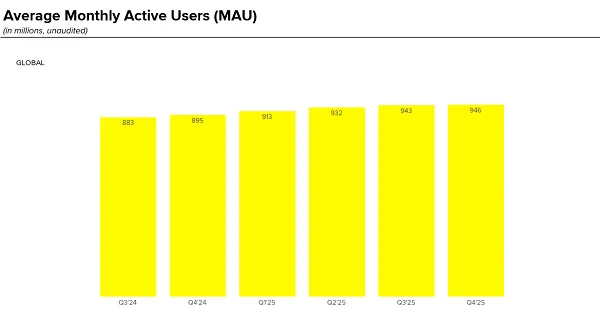

It’s additionally placing extra emphasis on month-to-month actives, which proceed to develop.

So, general, issues are nonetheless all good, proper? It might have fewer individuals logging in on daily basis, nevertheless it has extra coming by to take a look at the app each month. Which both signifies that Snap isn’t as important because it as soon as was, or that individuals are getting extra worth out of the app as an leisure platform, versus a day-to-day messaging utility.

However the actual problem for Snap is coming, with the launch of its AR Specs.

Snapchat has been working in direction of the discharge of its totally AR-enabled sun shades for years, longer than Meta or Apple have been working within the house, whereas it’s additionally lengthy been the chief in AR engagement, and creating viral tendencies from AR activations.

That may give Snap some market benefits, however going up in opposition to the infinite assets of Meta, which already has a maintain on the sensible glasses market, goes to be a tricky ask, irrespective of how Snap approaches it.

And it’s not going to work.

Snap’s cumbersome AR Specs are going to be heavier, much less useful, and fewer invaluable than Meta’s coming AR system, which is about for client launch subsequent 12 months. So whereas Snap goes to get forward of the sport, which might give it first-mover benefit, it’s not going to beat Meta on this entrance.

Snap has correctly cut up out Specs into its personal enterprise unit, with a view to defend its important enterprise from losses when its AR glasses inevitably fail. But it surely must tread rigorously right here, and never over-invest in a tool that’s unlikely to win out.

“We consider Snap is uniquely positioned to steer the following wave of spatial computing. With Snap OS 2.0, Lens Studio, Snap Cloud, and a world developer ecosystem, we’ve got constructed an end-to-end AR platform spanning software program, instruments, and {hardware}. Collectively, these capabilities place us to ship totally standalone, human-centered eyewear that expands inventive expression and unlocks new methods for individuals to have interaction with the world round them.”

That is the place Snap’s energy lies, in constructing an AR platform, however its personal system is simply not going to have the ability to maintain up as soon as Meta’s AR glasses arrive. And Zuckerberg additionally has a private vendetta in opposition to Snap for rejecting Meta’s takeover provide for the corporate a few years again, so you possibly can guess that Meta’s going to dampen any enthusiasm round Snap’s Specs any manner that it may.

That will likely be a key take a look at for Snap, as a enterprise, and for Evan Siegel as its chief.

General, that is the report card I’d have anticipated for Snap at this stage, with varied challenges forward of it, and restricted avenues to deal with them.

Will Snap overdo it with adverts, and switch extra customers away, or will it have the ability to get the steadiness proper, and capitalize on the customers that it has, which can then allay market fears about its shrinking person counts?