Picture supply: Getty Photos

I personal many various shares and funds in my SIPP. And that’s unlikely to alter any time quickly.

Nevertheless, not too long ago, I used to be serious about the shares I’d purchase for my account if I may solely select three. And right here’s the trio I got here up with.

Microsoft

Now, I don’t plan to retire for at the very least 15 years. So I’m on the lookout for long-term development. With that in thoughts, my first choose for my SIPP could be know-how powerhouse Microsoft (NASDAQ: MSFT).

Why Microsoft? Nicely, there are just a few causes.

One is that this firm is among the most dominant gamers in cloud computing. That is an business projected to develop considerably within the years forward and the corporate is already seeing glorious outcomes. Final quarter, for instance, cloud revenues have been up 29% yr on yr.

One other is the corporate is main the factitious intelligence (AI) revolution. Not solely is it a part-owner of ChatGPT, but it surely has additionally developed a ‘copilot’ AI function for apps like Phrase, Excel, and Groups.

“With copilots, we’re making the age of AI actual for individuals and companies in all places,” CEO Satya Nadella mentioned not too long ago.

Now, Microsoft is a comparatively costly inventory. At current, it has a forward-looking P/E ratio of about 29, which is a threat. However this firm is a real winner and, in my opinion, it has baggage of potential.

Alphabet

My subsequent choose could be Google and YouTube proprietor Alphabet (NASDAQ: GOOG).

That is one other tech firm with big development potential.

Like Microsoft, it’s a significant participant within the AI area. Already it’s launched Bard – its rival to ChatGPT. And within the close to future we are able to anticipate to see the launch of Gemini – an assortment of AI instruments used for chatbots, textual content technology, software program coding, and extra.

Alphabet can be a pacesetter within the digital promoting area. That is one other business that appears set for long-term development. The a part of the enterprise that excites me probably the most right here is YouTube. This platform is getting greater by the day and its development potential is limitless, to my thoughts. Final quarter, YouTube advert income was up 12% to $8bn.

Alphabet does face just a few dangers. Intense competitors from Microsoft and different tech firms is one. Regulatory intervention is one other.

I reckon numerous threat is baked into the share worth already nonetheless.

Presently, Alphabet’s P/E ratio is simply 19. I believe that’s a steal.

Nvidia

Lastly, my third choose could be Nvidia (NASDAQ: NVDA). It specialises in ‘accelerated computing’ {hardware} and software program.

The explanation I’d choose Nvidia is that it seems to be set to play a significant position within the AI revolution.

AI requires an enormous quantity of computing energy and all the massive gamers within the area are turning to Nvidia’s merchandise to energy their AI purposes (it presently has an 80% market share of the associated chip business).

So I see it as an important ‘pick-and-shovels’ play on AI. Regardless of who wins (there’ll most likely be a number of winners), it ought to do properly.

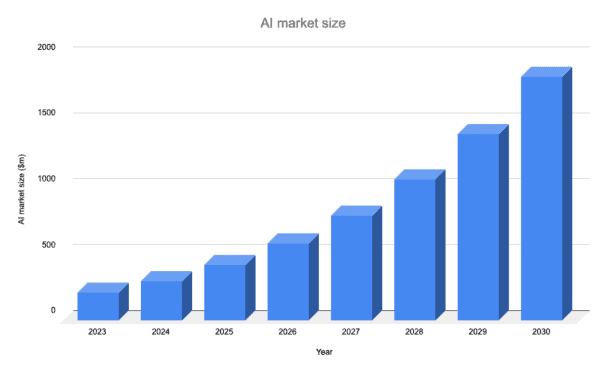

Supply: Statista, Subsequent Transfer Technique Consulting.

Now, it is a unstable inventory. So, I’d need to be ready for some wild swings in its share worth.

In the long term, nonetheless, I’d anticipate it to generate highly effective good points for my SIPP.