Picture supply: Getty Pictures

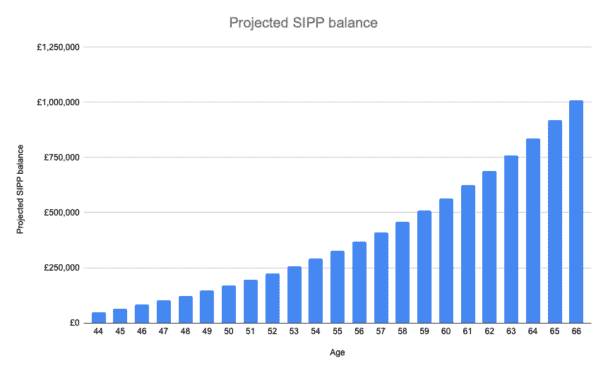

Final week, I hit a milestone in my SIPP (Self-Invested Private Pension). For the primary time since I opened the account a couple of years in the past, it was price greater than £50,000.

I’m fairly glad that my SIPP’s stability is above the £50k mark. Nevertheless, I’m aiming to construct up far more than that in my account within the years forward.

If I play my playing cards proper, I reckon it may hit the £500k mark earlier than I flip 60.

Constructing long-term wealth

Proper now, I’m 44.

And I contribute round £1,000 per 30 days (£12k per 12 months) to my SIPP.

Crunching the numbers, I calculate that if I used to be to proceed paying this a lot into my account going ahead, and I used to be in a position to generate a return of 8.5% per 12 months over the long run, I’d hit the £500k mark by 59 (and even £1m by 66).

Observe that loads of the expansion right here is as a result of magic of compounding (incomes returns on earlier returns), particularly within the later years.

For instance, between the age of 63 and 66, the projected stability jumps by about £250,000. That exhibits the ability of compounding.

It’s price declaring that I haven’t factored in any tax reduction right here as a result of I contribute to my SIPP instantly from my restricted firm (which reduces my Company Tax liabilities).

Nevertheless, if I used to be to issue this in, I’d hit the £500k and £1m milestones earlier.

Please notice that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

How I’m investing my SIPP

Now, I reckon an 8.5% return per 12 months may be very achievable.

Nevertheless, to realize this sort of return, I’ll want to take a position correctly and for me, meaning within the inventory market.

So, what I’m doing with my SIPP financial savings is investing in three primary areas to construct a rock-solid portfolio.

First, I’ve received some cash in tracker funds. These give me broad publicity to international inventory markets at a low value.

Then, I’ve received some cash in actively-managed funding funds. Examples right here embody Fundsmith Fairness, Blue Whale Development, Sanlam International Synthetic Intelligence, and Schroder International Healthcare. These ought to hopefully increase my long-term returns (all of them have glorious long-term observe information).

Lastly, I’m investing cash in particular person shares. Right here, I’m investing in firms that I believe are more likely to be the leaders of tomorrow.

Microsoft is one instance. It’s a frontrunner in each cloud computing and synthetic intelligence (AI), so I reckon it’s poised to get a lot larger over the following decade.

Nvidia is one other inventory I’ve purchased for my SIPP. It’s the dominant participant within the AI semiconductor area so I believe it’s set for robust development within the years forward.

I’ll level out that I anticipate this inventory market-based funding technique to have its ups and downs.

There are more likely to be some years after I make huge returns, some years when returns are just a little underwhelming, and a few years after I generate unfavourable returns.

I really feel that this diversified technique will ship good outcomes over the long run, nevertheless.

And if I maintain contributing to my SIPP frequently, I’m hope that my SIPP will hit seven figures finally.