Picture supply: Getty Pictures

Final yr, I thought-about including Fundsmith Fairness to my Shares and Shares ISA. Nonetheless, I got here to the conclusion that I wanted extra proof that supervisor Terry Smith might return to market-beating kind after 4 consecutive years of underperformance.

Final week, Fundsmith printed its 2025 annual outcomes. Based mostly on these, is now the time for me to speculate?

Efficiency

For these unfamiliar, Fundsmith invests in high-quality companies with sturdy manufacturers or aggressive moats, excessive returns on capital, predictable money flows, and the power to develop income while not having a lot debt.

Smith strips this right down to a easy three-step mantra: “Purchase good corporations. Don’t overpay. Do nothing.”

Placing this into follow, Smith trounced the fund’s benchmark (the MSCI World Index) between 2010 and 2020. Since then, although, Fundsmith has now underperformed for 5 straight years.

In 2025, it returned simply 0.8% in contrast with an increase of 12.8% for the MSCI World Index. In a robust yr when most indexes soared, that’s very disappointing.

What’s gone unsuitable?

Smith stated three issues assist clarify this underperformance:

- Excessive S&P 500 index focus

- Passive index investing

- Greenback weak point

The final one doesn’t actually concern me. However Smith factors out the ten largest shares accounted for 39% of the S&P 500 on the finish of 2025, delivering 50% of the full return.

With out proudly owning Magnificent Seven shares as giant positions, the fund supervisor argues it’s been very onerous to outperform lately.

Whereas true it’s tougher, it’s not unimaginable. For instance, Invoice Ackman (Pershing Sq.) and Chris Hohn (TCI Fund Administration) have efficiently outperformed the S&P 500 over the previous 5 years with out proudly owning Tesla, Meta, Apple, or Nvidia.

Moreover, he argues that passive index funds are distorting markets by shopping for shares with out regard for high quality or valuation, primarily making a momentum-driven bubble.

[E]ven if we’re proper in diagnosing this transfer to index funds as one of many causes of our current underperformance and it’s laying the foundations of a serious funding catastrophe, I’ve no clue how or when it is going to finish besides to say badly.

Terry Smith

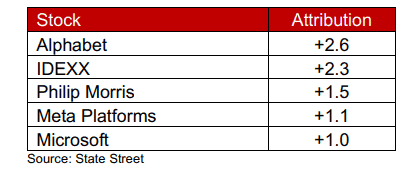

It’s value noting that Fundsmith owns three Magnificent Seven shares (Microsoft, Meta, and Alphabet), and all have been among the many prime 5 contributors to 2025’s efficiency.

Certainly, Meta ranked amongst Fundsmith’s prime contributors for the fifth time, with Microsoft making its tenth look. So, whereas Large Tech has helped drive the fund’s longer-term efficiency (which continues to be sturdy), Smith simply hasn’t had sufficient publicity to it.

Wegovy maker

Novo Nordisk (NYSE:NVO) crashed about 40% final yr, simply Fundsmith’s worst performer. The Wegovy maker fell behind rival Eli Lilly within the GLP-1 drug race, resulting in the ousting of its CEO.

Nonetheless, I word that the inventory has bounced again 17% to this point this yr, pushed greater by information that its Wegovy remedy has been authorized in a day by day capsule kind by US regulators.

In addition to bettering its aggressive standing, this might additionally get gross sales development transferring again in the appropriate route. The principle danger with this enterprise is Eli Lilly beating it once more with an improved GLP-1 drug.

Nonetheless, buying and selling at 16.7 instances ahead earnings, I believe Novo Nordisk inventory is value contemplating.

As for Fundsmith, although, I’m going to offer it a miss. The continued underperformance nonetheless worries me.