Picture supply: Getty Photos

The UK inventory market is filled with revenue shares which have lengthy data of unbroken dividend progress. As of right this moment, there are 30 shares on the FTSE 100 and FTSE 250 which have raised annual payouts for 20 years or extra.

The London Inventory Trade is filled with firms that some contemplate ‘good’ dividend shares. We’re speaking about companies whose market-leading positions, sturdy stability sheets, and various income streams result in ultra-stable dividends.

The UK additionally options numerous firms in mature or defensive industries, the place dividends are thought of a greater use for surplus money than investing for progress.

I’ve performed some analysis to search out the most effective dividend progress shares to contemplate proper now. Need to see what I’ve discovered?

5 of the most effective

Throughout my search, I’ve regarded for firms with stable dividend yields together with scope for additional long-term progress. They’re:

| Dividend share | Years of dividend progress | Ahead dividend yield |

|---|---|---|

| Clarkson | 22 | 3.1% |

| Alliance Witan | 58 | 2.3% |

| BAE Methods | 21 | 2.3% |

| Sage Group | 33 | 2.4% |

| Main Well being Properties (LSE:PHP) | 28 | 7.5% |

Every of the businesses enjoys most (if not all) of the qualities described above. However I believe one — Main Well being Properties — is a standout revenue share from this listing.

And it’s not simply because, at 7.5%, its ahead dividend is greater than double the FTSE 100 common of three.1%.

Please word that tax remedy is determined by the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

Wholesome dividends

Main Well being’s proud dividend file displays a number of key strenths.

Firstly, it operates in some of the defensive industries on the market. The vast majority of its properties are GP surgical procedures, although dental surgical procedures, pharmacies, and diagnostics centres additionally sit in its portfolio.

These types of properties stay in heavy use throughout the financial cycle, in contrast to these in different sectors like retail, workplace, and logistics. In truth, demand for them is booming because the UK’s ageing inhabitants drives healthcare wants, leading to excessive occpuancy ranges.

What’s extra, with rents which can be backed by authorities our bodies, the possibilities of hire defaults are slim-to-none.

Lastly, with roughly a 3rd of its portfolio topic to both inflation-linked or mounted uplift hire opinions, it has built-in mechanisms to assist it steadily increase dividends over time.

These qualities alone don’t assure constant dividend progress, after all. Corporations can sometimes select the dimensions of the shareholder payout. They will determine to not pay any dividends in any respect.

Nevertheless, Main Well being shareholders have extra safety on this entrance than most. It is because — underneath actual property funding belief (REIT) guidelines — it should pay no less than 90% of annual rental income out in dividends.

The underside line

As with all inventory, there are dangers for this FTSE 250 belief. One important one is a change in NHS coverage that impacts hire ranges and occupancy. Nevertheless, with major healthcare being a authorities precedence, an occasion like that is unlikely for my part.

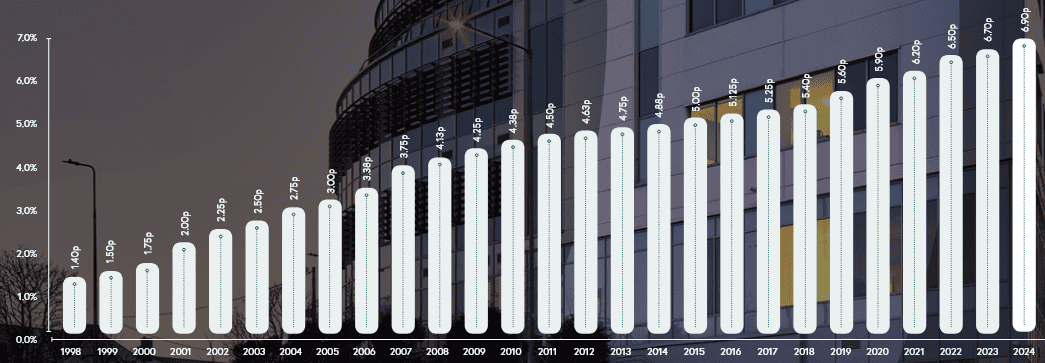

When all’s mentioned and performed, I believe Main Well being is without doubt one of the greatest revenue progress shares to contemplate right this moment.