Picture supply: Getty Photographs

Scottish Mortgage Funding Belief (LSE:SMT) is a FTSE 100 favorite amongst retail traders, together with some writers right here at The Motley Idiot. That’s partly as a result of it affords publicity to development firms that aren’t listed on public markets.

Importantly, these aren’t start-ups in dimly lit garages. Scottish Mortgage has chunky, long-held stakes in among the world’s most ground-breaking unlisted corporations.

For instance, funds infrastructure supplier Stripe processed roughly $1.4trn in complete fee quantity final 12 months. That was equal to about 1.3% of worldwide GDP!

In the meantime, TikTok proprietor ByteDance surpassed Fb and Instagram guardian Meta in world income earlier this 12 months.

One other holding, knowledge analytics agency Databricks, is reportedly in talks to boost capital at a sizeable $134bn valuation. It’s posting 50%+ development in the intervening time, pushed by rising use of its cutting-edge AI merchandise.

Final however definitely not least, there’s SpaceX, the reusable rocket pioneer that has ballooned in worth to turn out to be the funding belief‘s largest holding. And it was thrilling SpaceX information that despatched the Scottish Mortgage share worth up 3% as we speak (10 December).

Right here’s what shareholders have to know.

Potential blockbuster IPO

In keeping with Reuters, SpaceX is planning to checklist on the inventory market in June or July subsequent 12 months. It might look to boost over $25bn at a valuation in extra of $1trn.

Nonetheless, a Bloomberg article mentioned it might be as a lot as $1.5trn! In that case, that may rival oil firm Saudi Aramco‘s record-breaking preliminary public providing (IPO) in 2019.

That is improbable information for Scottish Mortgage shareholders as a result of the belief first invested in SpaceX again in 2018 at a far decrease valuation. And it obtained privileged entry to that fundraise after patiently supporting Elon Musk’s different considerably whacky enterprise (EV start-up Tesla).

Again in 2018, SpaceX was valued at about $31bn. So if this IPO efficiently goes forward, it could give a pleasant enhance to Scottish Mortgage’s web asset worth (NAV).

Presumably, it could enable the belief to crystallise some massive returns, offering money for brand spanking new investments and/or share buybacks.

Orbital knowledge centres

In fact, this IPO won’t occur. Lately, Elon Musk denied press reviews a couple of fundraise, writing that “SpaceX has been money movement constructive for a few years“.

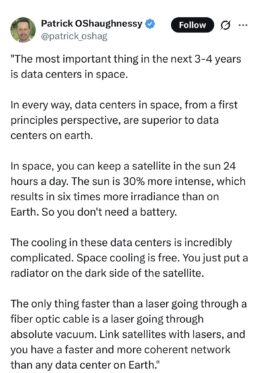

Nonetheless, it could want contemporary capital for space-based knowledge centres. These are being proposed as a way more energy-efficient resolution to knowledge centres on Earth.

If large tech corporations like Google and Microsoft begin sending knowledge centre infrastructure into orbit, the demand for SpaceX’s reusable Falcon 9 rocket may go into overdrive.

And if profitable, the agency’s gargantuan rocket Starship would take its aggressive benefits to a different stage (although it’s nonetheless within the testing section).

In the meantime, there’s Starlink, its web satellite tv for pc enterprise. This can drive a lot of the agency’s anticipated $22bn-$24bn in income subsequent 12 months.

Purchase SpaceX shares?

Would I put money into SpaceX? Probably, however the implied price-to-sales a number of of 50-65 seems very excessive. So I’d most likely wait.

Within the meantime, traders may take into account shopping for Scottish Mortgage inventory. Granted, it could be susceptible to a know-how sector sell-off, nevertheless it provides strong SpaceX publicity and is buying and selling at a lovely 12% low cost to NAV.

I believe affected person Scottish Mortgage shareholders will likely be rewarded with long-term market outperformance. However there will likely be ups and downs alongside the way in which.