Picture supply: Getty Photographs

For most individuals, the phrases ‘inventory market crash’ are sufficient to set off panic. From Black Monday in 1987 to the dotcom bubble in 2000, the 2008 monetary disaster, and the 2020 Covid crash — every has wiped billions off world markets in a matter of days.

However as historical past reveals, every crash was adopted by a powerful restoration. Slightly than panic, savvy buyers like Warren Buffett have been identified to hunt alternatives amid the chaos.

Retirement alternatives

For UK buyers hoping to construct a cushty retirement fund, a inventory market crash may really be a blessing in disguise. When panic hits, the costs of high-quality companies additionally dip — not simply the weaker ones. This ends in many shares buying and selling far beneath truthful worth.

That’s when long-term buyers can take benefit. By shopping for high quality firms when costs are depressed, portfolios can get well sooner and develop stronger – doubtlessly accelerating the trail to monetary independence.

The trick is being ready slightly than fearful. As a result of when the market dips, affected person buyers can usually choose up the identical companies at half the worth, and double their future returns as soon as issues normalise.

A latest instance

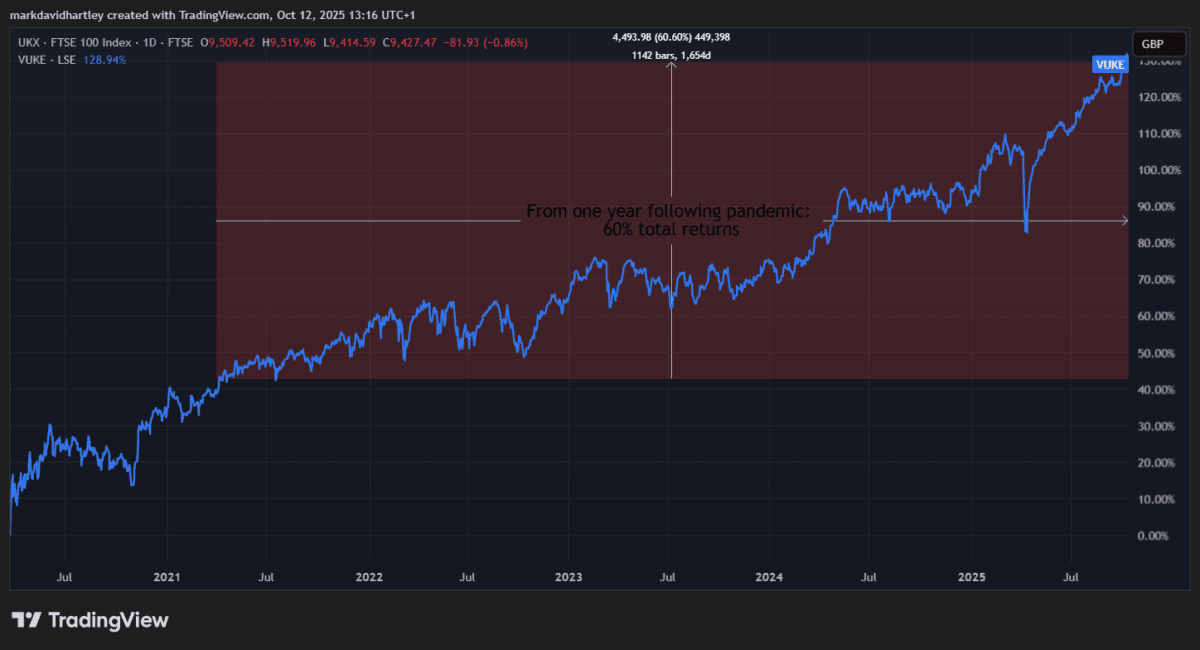

For the reason that pandemic lows in March 2020, the FTSE 100 has delivered a complete return of round 130% (together with dividends). That works out to roughly 15% a 12 months on common.

Buyers who waited till markets recovered a 12 months later noticed their whole returns fall to about 60%.

In fact, not each inventory survives a crash. Weaker firms usually get worn out fully. However resilient corporations with robust money movement, loyal clients and pricing energy have a tendency to come back again stronger.

Take Marks & Spencer (LSE: MKS), as an example. In its 141-year historical past, the retailer has survived wars, recessions and quite a few market crashes.

Following its pandemic low, the share value has surged roughly 300% — among the finest recoveries amongst UK retail shares. Which means £20,000 invested again then would now be value round £80,000.

Even a serious cyberattack earlier this 12 months hasn’t derailed the corporate’s progress. Earnings per share (EPS) fell to simply 1p in 2020 however have since bounced to 31p in 2024, with analysts anticipating 38p by 2028.

Out of 14 analysts protecting the inventory, 11 price it as a Sturdy Purchase, with a mean value goal suggesting 12% extra development over the subsequent 12 months.

Nevertheless, no firm is with out threat. Marks & Spencer faces intense competitors from low cost retailers and excessive working prices that might stress margins if shopper spending weakens. The latest knowledge breach additionally highlights vulnerabilities that might injury buyer confidence if not correctly managed.

A last thought

Timing markets isn’t smart, however preparation all the time pays. Common month-to-month investing – often called pound-cost averaging – stays probably the most dependable methods to construct long-term wealth. However holding a modest money reserve for when markets wobble could make an enormous distinction.

When the subsequent market downturn arrives, buyers who preserve calm and assume long run may flip short-term panic into long-term revenue.

A defensive inventory like Marks & Spencer is only one instance to contemplate when markets dip. There are a lot of comparable firms on the London Inventory Change with robust fundamentals and resilient enterprise fashions.

For these prepared to speculate, a inventory market crash may very well be the most effective factor to occur to a retirement plan.