Picture supply: Getty Pictures

Nvidia (NASDAQ:NVDA) shares are up 1,279% during the last 5 years. That’s sufficient to show £1,000 into one thing price £13,787.

The massive query for buyers is what comes subsequent. And whereas I’m not anticipating a repeat efficiency over the subsequent 5 years, I feel there are causes for optimism.

Development

The explanation Nvidia shares have been such a superb funding during the last 5 years is easy. The corporate makes far extra money than it did in 2020, principally attributable to spectacular income progress.

Traders ought to word, nevertheless, that issues have began to average lately. Quarterly gross sales progress charges have fallen from 265% within the final three months of 2023 to 56% in the latest quarter.

| Quarter | 12 months-over-12 months Income Development |

|---|---|

| Q1 2024 | 262.12% |

| Q2 2024 | 122.40% |

| Q3 2024 | 93.61% |

| This autumn 2024 | 77.94% |

| Q1 2025 | 69.18% |

| Q2 2025 | 55.60% |

That’s totally regular for a corporation of Nvidia’s dimension, nevertheless it’s extraordinarily essential. As progress charges sluggish, the valuation multiples the inventory trades at have come to replicate much less optimistic assumptions.

Over the past two years, the price-to-earnings (P/E) ratio the inventory trades at has fallen from 110 to 50. That’s nonetheless excessive, nevertheless it’s a big decline from the place it was.

Different issues being equal, that’s sufficient to trigger the share worth to fall by greater than 50%. However different issues aren’t equal on this case – wider margins have induced earnings per share to develop extra rapidly.

Trying forward, I feel income progress is prone to preserve slowing. However the query for buyers is whether or not progress will keep sturdy sufficient to justify a P/E ratio of 49.

Outlook

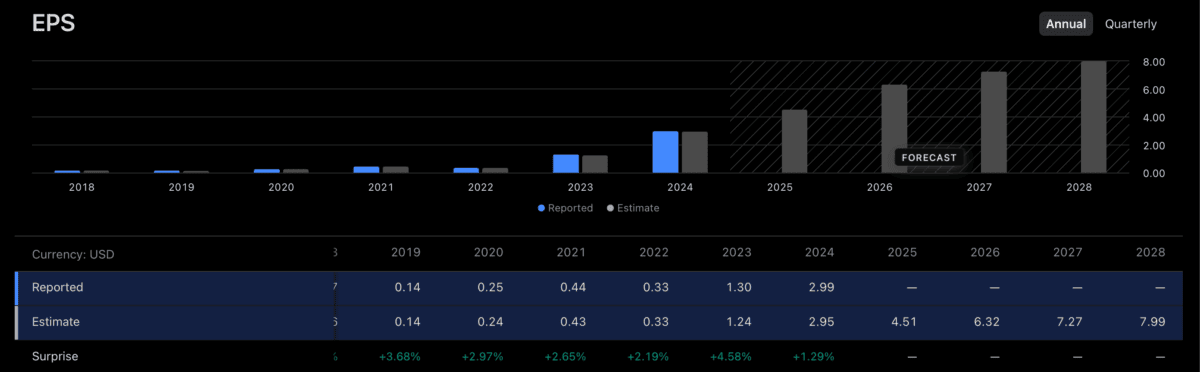

Analysts predict gross sales to develop round 32% in 2026, then 17% in 2027, and eight% in 2028. That’s fairly a dramatic decline, however earnings per share (EPS) are forecast to develop extra rapidly.

Nvidia’s EPS is forecast to achieve $7.99 by 2028, which entails 40% progress in 2026, which is ready to sluggish to 10% by 2028. That is perhaps proper, however I don’t see progress slowing a lot from there.

If I’m proper, Nvidia’s EPS may attain $9.67 by 2030. In that scenario, I anticipate the inventory to commerce at a P/E ratio between 25 and 30, which suggests a share worth within the $241-$290 vary.

That’s between 38% and 65% above the present stage – sufficient to show £1,000 into £1,650. That’s a great distance from the return of the final 5 years, nevertheless it wouldn’t be a foul end result by any means.

All of this, nevertheless, depends upon the agency sustaining its aggressive place. Proper now, Nvidia chips are indispensable to the rise of synthetic intelligence and future EPS progress depends on this.

Gauging the chance of competitors is troublesome. However there’s a hazard that the US proscribing exports to China may end in a drive for innovation in Asia, leading to a DeepSeek-style various.

Dangers and rewards

As with all inventory, investing in Nvidia is about gauging dangers and rewards. And whereas I feel there’s nonetheless room for optimism, it’s positively much less enticing than it was 5 years go.

Whereas there aren’t any apparent rivals, the chance of 1 rising must be thought-about rigorously. So buyers may wonder if they’ve higher alternatives elsewhere in the intervening time.