Picture supply: Getty Photos

Information in regards to the State Pension is never out of the headlines. Neither is theory over future residing requirements for retirees, emphasising the significance of long-term monetary planning with pensions or financial savings merchandise just like the Particular person Financial savings Account (ISA).

Britain isn’t alone in going through a retirement disaster. Deteriorating public funds, mixed with ageing populations, increase questions on how governments internationally will be capable to fund future pensions.

It’s a sobering thought. However it’s by no means too late to begin constructing wealth to keep away from monetary hardship in later life. Let me present you the way a diversified fund might assist safeguard one’s monetary future.

Heed the warnings

Feedback on Monday (21 July) from the UK authorities underline the ticking timebomb going through Britons immediately.

Based on Division for Work and Pensions (DWP) analysis, folks retiring in 2050 will probably be 8% — or £800 — worse off than these exiting the workforce immediately.

To deal with this disaster, the federal government stated it’s resurrecting the Pensions Fee, which is able to “study the complicated boundaries stopping folks from saving sufficient for retirement“. However that’s not all — its function will even be to “study the pension system as an entire and take a look at what’s required to construct a future-proof pensions system that’s robust, honest and sustainable“.

On high of this, one other authorities assessment will analyse the age at which individuals can start claiming the State Pension.

The present pension age of 66 is scheduled to rise to 67 between 2026 and 2028, and once more to 68 between 2044 and 2046. However some economists and business specialists are warning these modifications may very well be introduced ahead.

Focusing on a £44k passive revenue

I don’t find out about you. However I don’t need to put myself on the mercy of adjusting authorities coverage. I need to retire at a good age, and to get pleasure from a snug way of life after I do.

My plan is to construct my very own retirement fund with money, shares, trusts, and funds, utilizing a spread of ISAs and my Self-Invested Private Pension (SIPP). By prioritising investing within the inventory market, I feel I can obtain a long-term common annual return of 8% whereas nonetheless successfully managing threat.

At that price of return, a month-to-month funding of simply £500 over 30 years would create a retirement nest egg of £745,180. At this stage, one might get pleasure from an annual passive revenue of £44,711 in retirement if invested in 6%-yielding dividend shares.

And that’s excluding any potential help from the State Pension.

Wealth constructing fund

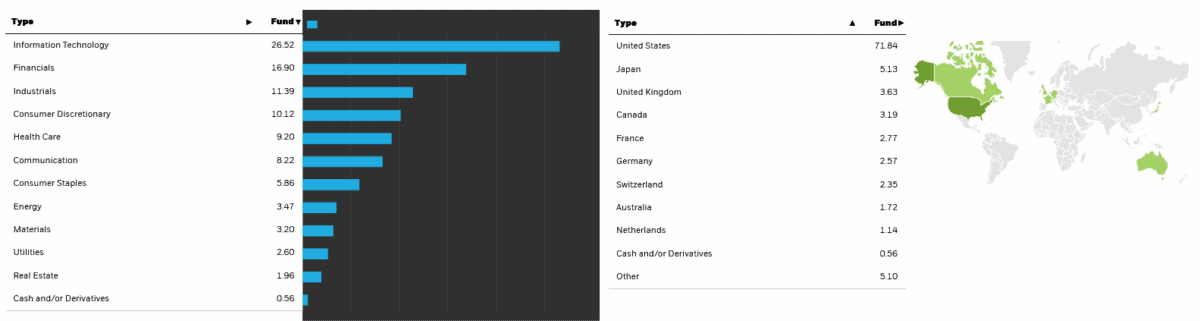

World funds just like the iShares Core MSCI World Index (LSE:IWDG) might be highly effective weapons in serving to me obtain this. Diversification throughout areas and sectors ship glorious threat administration whereas not compromising the chance to make life-changing returns.

Certainly, this exchange-traded fund (ETF) has delivered a median annual return of 10.9% since its creation in 2017.

Fairness-based autos like this could ship disappointing returns throughout market downturns. However as this iShares fund has proven, over the long run they’ll successfully harness the potential of the inventory market and ship nice returns. Main holdings right here embody Nvidia, Amazon, and Berkshire Hathaway. In whole it holds shares in 1,324 international shares.

With publicity to highly effective progress sectors like IT and monetary companies, I feel this fund might stay a wonderful wealth builder. It’s one in all a number of funds I feel demand severe consideration.