Picture supply: Getty Pictures

Historical past reveals that proudly owning a variety of dividend shares, funding trusts and exchange-traded funds (ETFs) will be an efficient technique of constructing passive earnings over time. Doing so reduces the influence of dividend hassle amongst one or two shares on general shareholder returns.

I believe the next mini-portfolio — providing publicity to a complete of 346 corporations — might be a good way to focus on a big, dependable and rising second earnings over time. Right here’s why I believe they’re value severe consideration.

The dividend inventory

FTSE 100 firm M&G‘s (LSE:MNG) been lifting dividends persistently because it was spun off from Prudential in 2019. Although income have been up and down resulting from rising rates of interest and weak financial progress, payouts have stored rising because of the agency’s strong stability sheet.

With a Solvency II ratio of 223%, it appears in good condition to maintain this file going.

Current share worth power has pulled its dividend yield away from double-digit share territory. However at 8.1%, it nonetheless packs the third-largest yield on the Footsie at this time.

That is additionally greater than double the blue-chip index’s broader common of three.4%.

M&G’s share worth might reverse if financial circumstances worsen. However the long-term outlook right here is strong, in my view, as an ageing inhabitants drives demand for its funding and retirement merchandise.

The ETF

At 8.8%, the ahead yield on the iShares World Fairness Excessive Revenue ETF (LSE:WINC) additionally leaves the FTSE 100’s corresponding common within the mud. And with holdings in 344 completely different corporations, it’s capital allocation successfully protects investor returns if a handful of shares ship disappointing dividends.

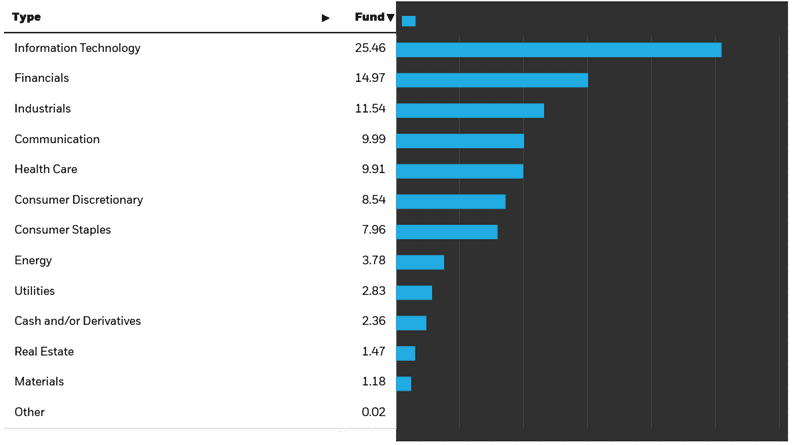

Because the chart above reveals, this fund invests in a variety of sectors, decreasing danger and offering a clean return throughout the financial cycle. It additionally holds cash in US goverment bonds and money for added robustness.

What’s extra, as its identify implies, the product invests in shares from throughout the globe, together with the US (67.8% of the portfolio), Japan (6.9%), France (2.9%) and the UK (2.2%).

This excessive weighting of US shares might influence efficiency if buyers rotate away from North America. However I believe it balances danger and return fairly successfully.

The funding belief

Main Well being Properties (LSE:PHP) is an actual property funding belief (REIT) which may make it excellent for dividend earnings. Sector guidelines dictate {that a} minimal of 90% of annual rental income should be paid out in money to buyers.

This REIT has particularly confirmed top-of-the-line dividend-paying REITs in current many years. Shareholder rewards have risen every year for the reason that mid-Nineties.

Please word that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

It’s a file that additionally displays its supreme earnings stability. By renting out major healthcare amenities, it advantages from an ultra-defensive sector the place round 90% of rents are funded by authorities our bodies.

Increased rates of interest have weighed on Main Well being’s share worth lately. Whereas this stays a danger, indicators of falling inflation suggests higher instances might be forward.

The dividend yield here’s a massive 7%.