Picture supply: Meta Platforms

For no matter cause, I’ve by no means owned shares of Meta Platforms (NASDAQ: META) in my Shares and Shares ISA. They’re up 750% in a decade, so this has been an enormous missed alternative.

Meta was referred to as Fb, after all, and in addition owns Instagram. These two platforms are the commercial money cows, however it hasn’t performed something revolutionary with WhatsApp because it purchased the messaging app 11 years in the past.

That may be about to vary, although. On 16 June, Meta introduced that advertisements will lastly be coming to the world’s hottest messaging app, which now has roughly 3bn month-to-month customers.

The potential monetisation alternative could possibly be huge. Given this, ought to I rush out to purchase Meta inventory proper now? Right here’s my take.

An AI big

To be truthful, I used to be already bullish on the inventory earlier than this announcement. The quantity of buyer information the agency has is mind-boggling, and this provides it an enormous benefit within the age of AI. It could possibly use the expertise to each enhance focused advertisements and enhance person engagement.

Simply final week, in actual fact, a buddy advised me how scarily good Instagram’s advertisements have change into. He says it’s just like the algorithm is aware of what he desires earlier than he does!

The corporate has confirmed that AI is certainly already delivering tangible advantages. Within the six months to the tip of March, enhancements to its suggestion methods led to a 7% enhance in time spent on Fb, 6% extra on Instagram, and 35% on Threads.

In Q1, income grew 16% 12 months on 12 months — or 19% at fixed foreign money — to $42.3bn, whereas web revenue totalled a cool $16.6bn (up 35%). A mean of 3.43bn individuals used Meta’s apps day by day, up 6%.

In current days, the corporate introduced it was investing $14.3bn to pursue synthetic basic intelligence (the holy grail of AI). Once you generate as a lot money as Meta does, I suppose you may give it a crack.

Total, we’re centered on constructing full basic intelligence…The tempo of progress throughout the business and the alternatives forward for us are staggering.

CEO Mark Zuckerberg, Meta Q1 2025 earnings name

Monetising WhatsApp

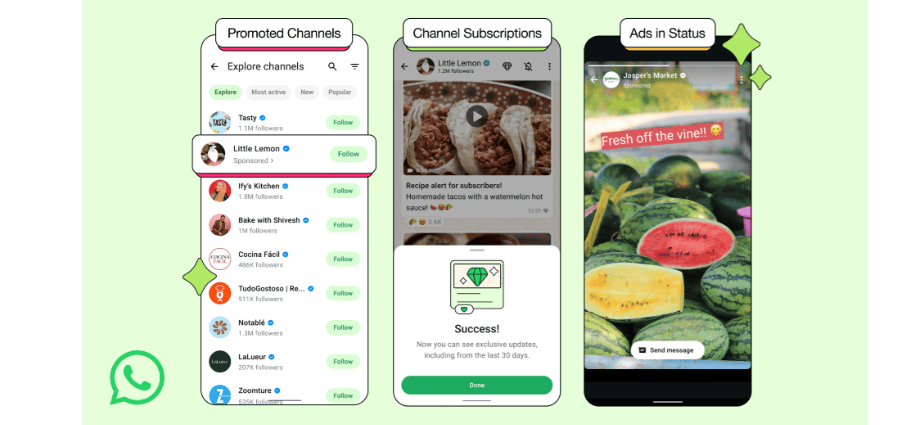

In WhatsApp, the corporate is introducing channel subscriptions, promoted channels, and advertisements within the “Updates” tab to assist customers discover channels/merchandise they’re desirous about. They are going to be stored separate from private conversations, fortunately.

Talking as a daily WhatsApp person, I’ve blended emotions. I have already got merchandise I’m desirous about — in addition to these I’m not — flying at me from all angles. Radio, electronic mail, YouTube, Netflix, and so forth. I’m not too eager on signing as much as see extra on my day by day messaging app.

Crucially although, Meta says private messages will stay end-to-end encrypted and won’t be used for advert focusing on. Regardless of this, I believe some WhatsApp customers would possibly concern that Fb-style monitoring is on the best way, driving them to Telegram, Sign, or different options. So this new characteristic will not be completely risk-free, in my view.

Whether or not or not this strikes the needle stays to be seen. However at present buying and selling at 27 instances ahead earnings, I don’t assume the inventory is overvalued. Traders would possibly subsequently wish to think about it at present.

As for me, I’m going to place it on my watchlist as a possible candidate to purchase on a dip.