Businessmen work with inventory market investments utilizing smartphones to research buying and selling information. smartphone with inventory trade graph on display screen. Monetary inventory market.

Searching for methods to handle threat however nonetheless goal mammoth long-term returns? Listed below are three funding trusts from the FTSE 250 I believe deserve a better look.

Useful Murray

As its identify implies, the Murray Earnings Belief (LSE:MUT) is a real hero for traders searching for a big and rising passive earnings. And right this moment it may be picked up at very low value.

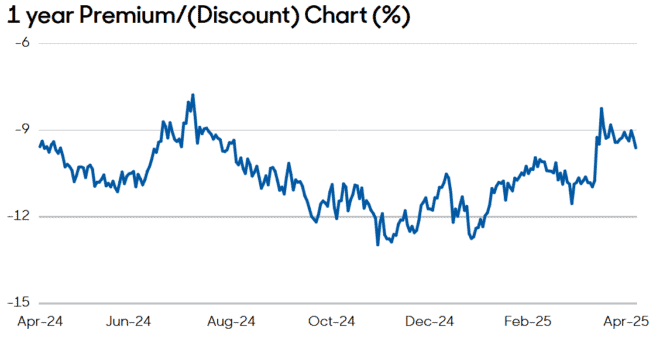

At 854p per share, it trades at a 9.6% low cost to its internet asset worth (NAV) per share:

Dividends at Murray Earnings have grown for 51 consecutive years. However in contrast to among the UK’s dividend progress trusts, the yields listed here are removed from disappointing. For this 12 months it sits at 4.8%, far forward of the FTSE 100‘s 3.4% common.

It’s in a position to do that because of a give attention to a variety of income-paying UK blue chip shares. Distinguished holdings embrace Unilever, RELX, AstraZeneca and Nationwide Grid.

This cross-sector publicity gives added energy, although do not forget that its give attention to British shares creates regional threat. Murray Earnings’s delivered a median annual return of 4.9% since 2015.

Take it to the financial institution

At 116.4p per share, the Bankers Funding Belief (LSE:BNKR) trades at a 9.5% low cost to its estimated NAV per share. For traders searching for to successfully diversify their holdings, I believe it’s value severe consideration.

In complete, this funding belief has holdings in 101 totally different corporations spanning the globe. As you’ll be able to see under, it’s fairly properly diversified by sector and geography, though a big weighting of US tech shares gives it with huge progress potential because the digital economic system booms:

In accordance with its web site, Bankers Funding Belief is ready up “to realize capital progress in extra of the FTSE World Index and dividend progress higher than… the UK Client Costs Index.” It’s executed a fairly good job of this, with dividends rising for 58 years on the spin.

Whole annual returns right here have averaged 7.9% since 2015. Whereas an financial slowdown may affect its tech holdings, I believe it’s nonetheless an incredible belief to think about, and particularly at right this moment’s costs.

Rock stable

Investing within the BlackRock World Mining Belief (LSE:BRWM) carries extra threat right this moment. Because the identify implies, 100% of its holdings function within the cyclical world of commodities manufacturing.

Not solely this, however the business it’s targeted on is susceptible to vital unpredictability. Disappointments will be frequent on the exploration, mine development and manufacturing phases, which means gross sales and value projections can fluctuate wildly.

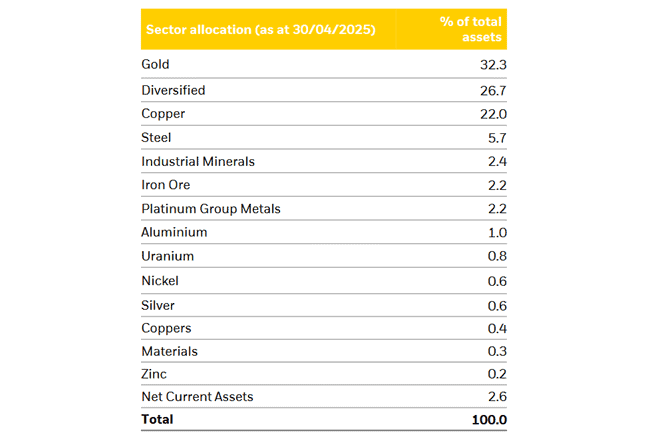

However with holdings in additional than 60 totally different mining corporations — together with diversified heayweights Rio Tinto, BHP and Glencore — it successfully spreads this threat out. Its large wingspan additionally gives safety from localised points in particular commodity markets and international locations (nearly 60% of its holdings function the world over):

At 517p per share, the BlackRock World Mining Belief trades at a 6.5% low cost to its NAV per share. Delivering a median annual return of 9.8% since 2015, I believe it’s value a severe look right this moment.