Picture supply: Getty Photographs

Investing in FTSE 250 shares could be a superb solution to construct long-term wealth. It’s why I’m planning to extend my publicity to such shares in 2024. If previous efficiency is something to go by, this technique may assist me create a life-changing passive revenue stream.

The FTSE 100 is a well-liked place for brand new and skilled traders alike to park their money. I personal a variety of blue-chip shares together with Aviva, Diageo, Rio Tinto and Unilever in my portfolio.

However I additionally personal a cluster of FTSE 250 corporations like Video games Workshop and Spire Healthcare. And there are actually dozens of different prime shares from London’s second-tier index I’m contemplating shopping for.

Historical past means that £300 invested every month in FTSE 250 shares may assist me generate a second revenue of £33,654 for the remainder of my life. Right here’s how.

A FTSE 250 technique

The superb long-term returns that UK share investing offers is effectively documented. The FTSE 100, as an illustration, delivered a mean annual return of round 7.5% between its inception in 1984 and 2022.

Nonetheless, returns from the FTSE 250 have been even better. Because it started life in 1992, the index has supplied a mean annual return of 11%.

Previous efficiency isn’t any assure of the longer term. However let’s assume these charges of return proceed for the following 30 years. What would a £300 month-to-month funding flip into?

| Timescale | FTSE 100 | FTSE 250 |

|---|---|---|

| 5 years | £21,758.13 | £23,855.42 |

| 10 years | £53,379.10 | £65,099.44 |

| 20 years | £166,119.22 | £259,691.41 |

| 30 years | £404,233.63 | £841,355.92 |

Huge distinction

As we are able to see, over a 30-year interval I might earn greater than twice as a lot by choosing FTSE 250 shares as a substitute of FTSE 100 ones.

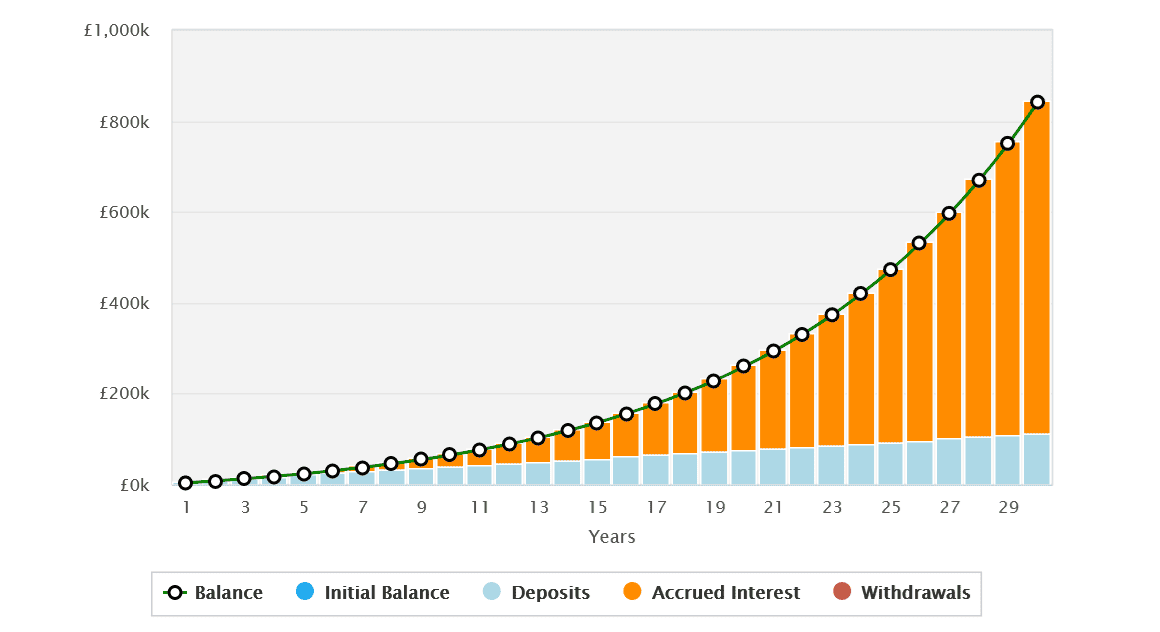

A small distinction within the brief time period step by step spirals over these three a long time, because of the miracle of compounding. This entails the regular reinvestment of dividends, which might give me much more shares and (by extension) dividends, giving me an more and more massive pot to earn cash on.

The chart beneath exhibits simply how mighty a weapon compounding could be in creating long-term wealth.

So we’ve managed to make a whopping retirement pot of £841,355.92 after 30 years of standard funding. Now let’s switch that right into a second revenue through the use of the 4% drawdown rule.

This technique would let me draw a retirement revenue for 30 years earlier than I run out of cash. On this instance it will give me a beneficiant annual revenue of £33,654.24.

A £33,654 passive revenue

Incomes a £30k+ revenue for doing nothing is a fairly thrilling prospect, I’m positive readers will agree. However as with every funding, buying UK shares isn’t with out danger.

Within the case of the FTSE 250, annual returns may path these historic ranges ought to the British economic system endure sluggish development. This as a result of the index is extremely geared in the direction of corporations that earn most or all their income from these shores.

However as I’ve proven, constructing a portfolio of FTSE 250 shares may additionally generate life-changing riches and pace up the journey to monetary freedom. Because of this I plan to proceed including to my shares portfolio lengthy into the longer term.